July 19, 2023 by Lawrence Yun

Real estate investors have done well. Rents have risen and home price appreciation has been quite exceptional. In the past three years, the typical rental rate and typical home price have soared by 16.4% and 35.5%, respectively. Over the past five years, those figures are 24.9% and 50.8%. These returns were occurring at a time of low-cost financing.

Now it’s time for investors to sell. Home prices have already retreated in some markets—especially in the west, where the median price is 8% lower than a year ago.

There are 44 million renter households: Half live in midsized to large apartment buildings, while the other half rent single-family, duplex, triplex or quadplex units. Although apartments are not necessarily as competitive as single-family rental units, a 40-year high in multifamily construction means many units will be hitting the market in the upcoming months and into next year. Rent growth has already turned the corner from acceleration to deceleration, still rising in most markets but at a slower pace. Looking at single-family construction, builders are still underproducing compared to the historical average, but new-home sales are back to pre-COVID levels. Home builders are making profits, stock prices for publicly listed construction companies have risen by around 50% in the past year, and inventory of new homes is plentiful.

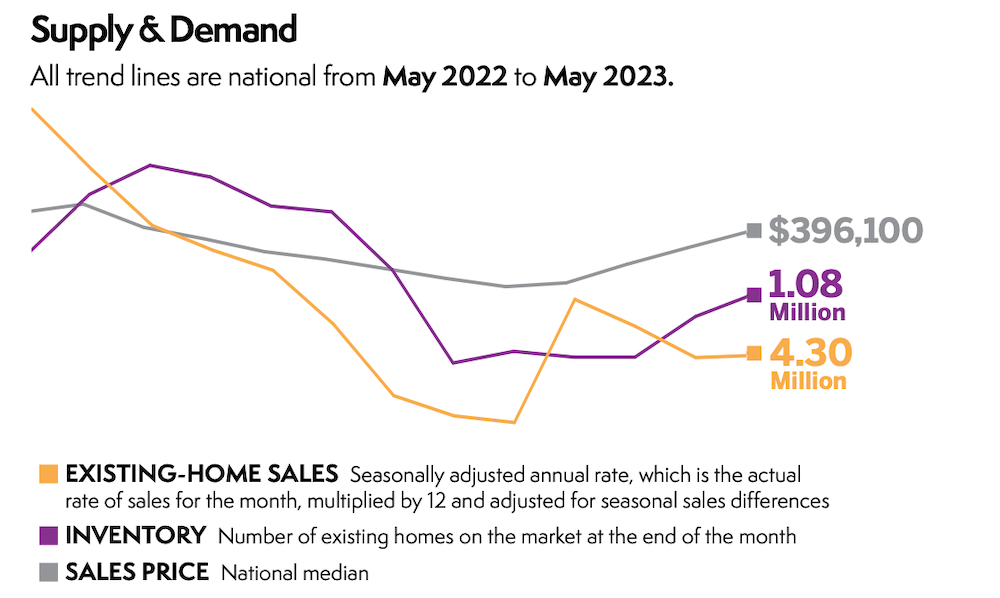

That’s not the case for existing homes. The latest inventory of 1 million is a historic low, and that’s hindering existing-home sales. Multiple offers are still happening on mid-priced homes. We need 50% growth in listings to reach pre-pandemic 2019 levels. We need 100% growth to reach an adequate supply. This is where investors come in—or rather, come out. The National Association of REALTORS® is calling for a federal incentive to help bring needed inventory to the market: temporary capital gains relief for investors who sell to a first-time buyer or first-generation buyer.

Days on Market Trend Down

Properties remained on the market for a median of 18 days in May, down from 22 days in April but up from 16 days in May 2022. Seventy-four percent of homes sold in May were on the market for less than a month.

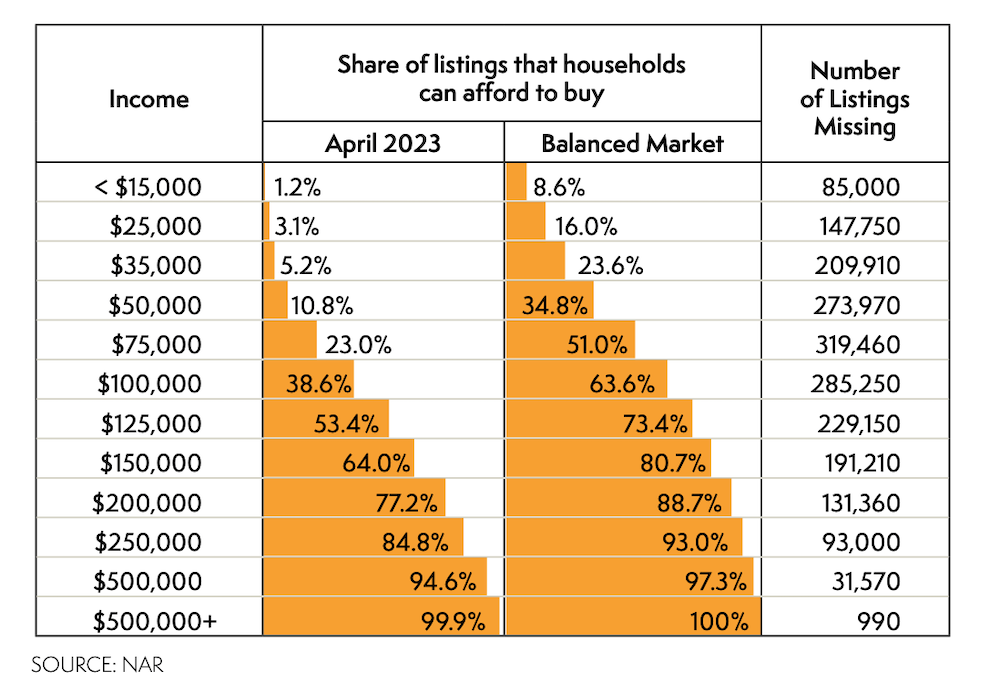

Affordability and Supply

A new NAR and realtor.com® study estimates how many homes are “missing” from the market by income level. The largest shortage of homes is in the price range that middle-income buyers can afford.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link